Tax Rate For Married Filing Jointly 2025

Tax Rate For Married Filing Jointly 2025. Keeping an eye on tax rates can help you make. Standard deduction amounts are increasing in 2025, to $15,000 for single filers and $30,000 for married couples filing jointly.

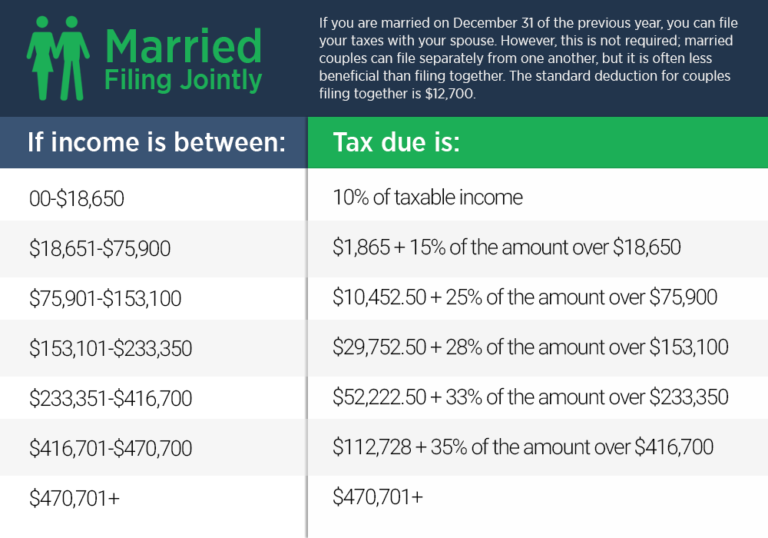

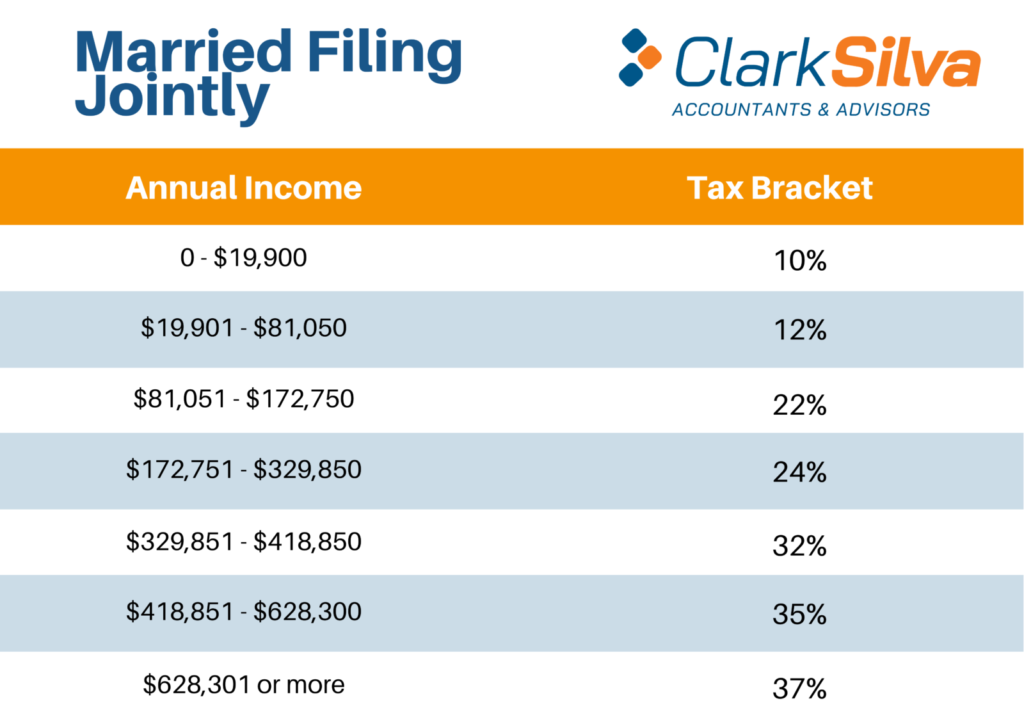

To figure out your tax bracket, first look at the rates for the filing status you plan to use: Single, married filing jointly, married filing separately, or head of household.

Tax Rates 2025 Married Filing Jointly Frank Morrison, The standard deduction for married couples filing jointly will drop from around $30,000 in 2025 to about $13,000 (adjusted for inflation), while the deduction for single filers.

New Tax Brackets 2025 Married Jointly Hinda Leelah, Standard deduction amounts are increasing in 2025, to $15,000 for single filers and $30,000 for married couples filing jointly.

Federal Tax Rates 2025 Married Filing Jointly Gavin Skinner, Single, head of household, married filing jointly, married filing separately, and.

Tax Rate Married Filing Jointly 2025 Barbee Maitilde, Amt exemptions phase out at 25 cents per dollar earned once amti reaches.

Federal Tax Rates 2025 Married Filing Jointly Gavin Skinner, See current federal tax brackets and rates based on your income and filing status.

Tax Rate 2025 Married Filing Jointly Cymbre Oralie, For married couples filing jointly, the capital gains tax system offers a few thresholds.

2025 Tax Brackets Announced What’s Different?, Note that, in considering the table below, a 20 percent tax rate applies to capital gains that.

Tax Rates Heemer Klein & Company, PLLC, Standard deduction amounts are increasing in 2025, to $15,000 for single filers and $30,000 for married couples filing jointly.

2025 Federal Tax Tables Married Filing Jointly Della Farrand, Brackets are adjusted each year for inflation.

Tax Bracket 2025 Married Filing Separately With Dependents Cris Michal, To figure out your tax bracket, first look at the rates for the filing status you plan to use: